In this article we would like to review the latest developments in fintech. We look at the market from the standpoint of mid-2020 and would like to explore trends that have an impact now and in the future. We look at new solutions, partnerships, investments and regulations, and explore how they together shape financial services and innovation. This year is a special one: we see the economy taking severe hits because of measures and fears of the Covid-19 outbreak. And still there is large uncertainty on what the second half of the year will bring. The virus outbreak has an impact on fintech activities as well, both negative and positive.

Just like in most (services) industries, financial services companies, small and big, had to work from home and got to embrace tools like Meet, Teams, Skype, Zoom, GoToMeeting and more platforms to facilitate remote collaboration, meetings and even larger events. The whole world has seemed to have gone online, and it is not very likely that all will return to normal. People have experienced that working remotely can actually work well, to a certain extent, and that makes it likely that the flexibility to do so will most likely stay part of the way we work from now on. Companies are currently back to 1 or 2 days at the office – with careful planning – and we might not see that number rise soon or at all. This puts quite some pressure on the commercial real estate business, as you can imagine.

Besides online collaboration tools, we also saw the payments industry come to accelerate. Many fintech solutions that specialise in e-commerce or digital payments, saw a big surge in transaction and profitability. Most consumers started shopping online to avoid crowded shops and supermarkets and when doing a physical transaction, cash is mostly out of the question from a hygiene perspective. And ecommerce parties had their hands full fighting fraudsters and dealing with new reporting requirements. Big game for the payments industry.

Not just consumer business has been booming for fintech players, also business to business there has been strong growth for all players that reinforce digital processes and collaboration. All organisations where paper processes, wet signatures or stamps would still determine credit or onboarding processes still dominate, realised soon enough that working remotely required immediate investment in digital processes. Especially knowing your client processes, credit approvals, and transaction monitoring saw a steep increase, also driven by increased action from the EU and regulators on anti-money-laundering. This has also driven incumbent financial institutions to join forces – mostly with consent or collaboration of government and regulators – to set up a shared KYC and or AML facility.

Collaboration in general has taken a hit. Without any physical events and meetings possible for quite some time, several companies focussed on growth, have a hard time building trust with their prospective customers. The sectors that experienced growth are the ones with extended business with existing customers, or relationships that were already in the making before lockdowns kicked in. This holds mostly for b2b transactions, as retail (consumer & SME) customers are already more used to doing business online with relatively (personally) unfamiliar parties.

Venture capital investments have taken a brief hit in the early days of the Corona crisis, when valuations when smaller deals fell through and larger deals often saw re-negotiated valuations. But in line with the stock market, the venture capital flow has come back online completely – al be it good to note that most of the funding rounds that are announced now still build on relationships that got introduced before lockdowns. Digital relationship only deals are rare so far.

Governments rolled out serious support schemes for companies to cope with demand fall and keep staff employed. The measures were all focussed on creating cash relief and to minimize layoffs, and included grants, tax holidays and government backed loans. At first, these measures were driving entrepreneurs in the arms of traditional banks who were best equipped to deal with the governmental administration required to provide state guaranteed loans. However, quite quickly the alternative finance sector also picked up on the opportunity and was able to convince governments to include them in the guaranteed loan schemes. In several countries, they proved far more efficient than traditional banks, especially in the cases where governments were willing to adapt their procedures to digital lenders – for instance by eliminating paperwork.

This increased collaboration also provides great opportunities for cybercrime, it became clear. We saw phishing attacks and CEO-fraud surge, while consumers and employees lacked their day-to-day sparring partners to validate these messages. Also new champion online communication platforms like Zoom and skype introduced new risks, as millions flocked their platform to keep business running. Most of the difficulties have been resolved here in just a few months to tackle privacy concerns and security risks. The rise in potential cybercrime has also opened up a large opportunity to speed up digital identity, identity verification and fraud prevention solutions, that make up quite a large proportion of the Fintech landscape. As many of these solutions have a strong regulatory drive behind them, they are often also referred to as regtech, also encompassing tools and solutions that enable companies to become and stay compliant.

Most regtech companies thrived after the initial shock that reverberated through society and the economy, when lock downs were announced, and businesses were confronted with unprecedented uncertainty. After the first weeks of adapting to working from home, many regtech companies saw business accelerate, as incumbent financial institutions had to stay compliant while working remotely and dealing with an increased digital services demand from customers. This was also fuelled by the strong enforcement of anti-money laundering (AMLD5) and sanctions, and the fear for high fines at financial services companies of all sizes. Not just compliance-oriented solutions benefitted from this, actually most software vendors and in particular banking platforms, enabling banks to go digital, thrived.

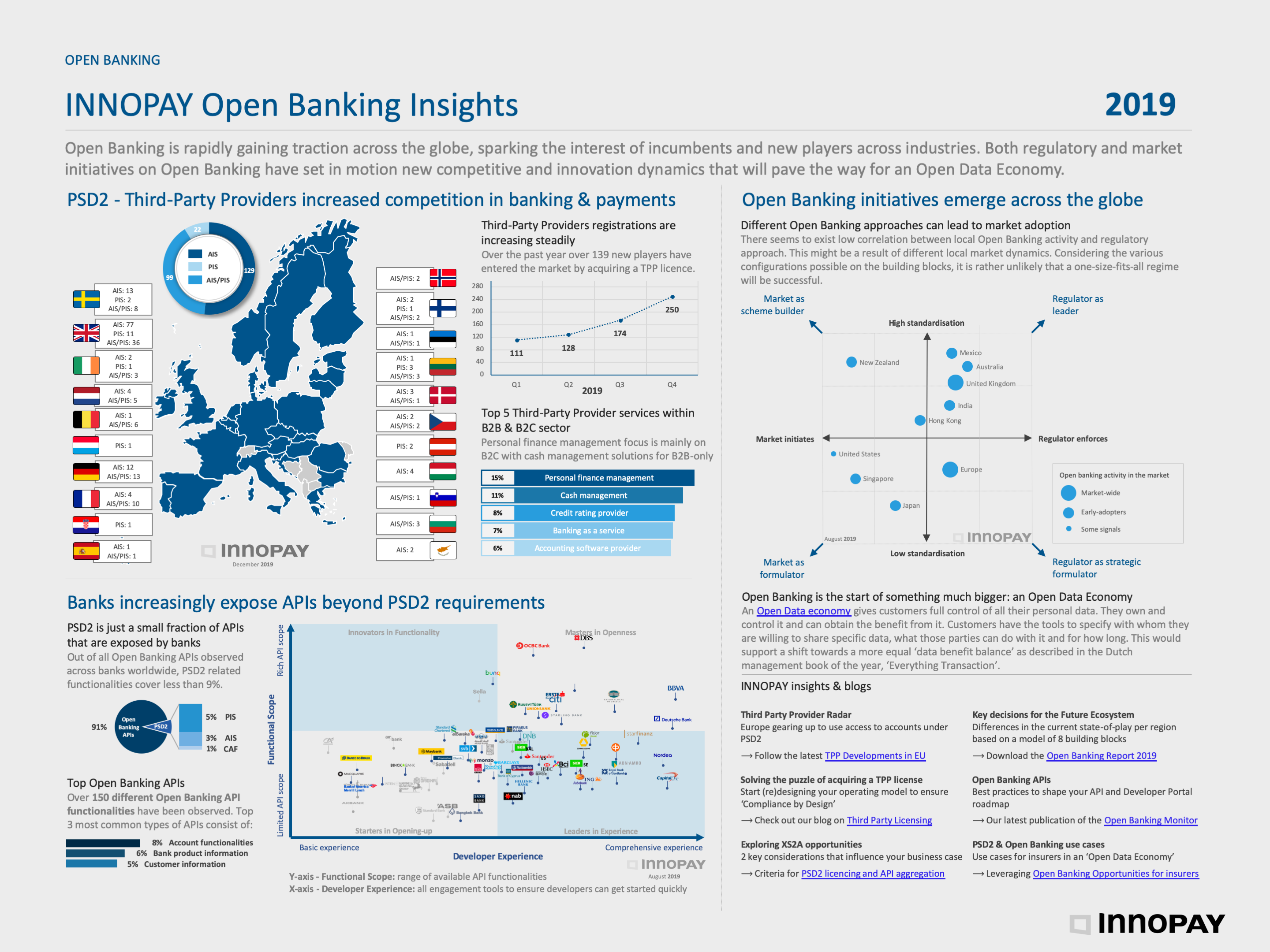

Digitization at banks already stepping up due to regulations like PSD2 – the new Payment Services Directive by the European Committee – forcing banks to open up their payments transaction data to user and their service providers (Third PartProviders, or TPP’s), that should be able to retrieve the data of a client through smooth API’s (Application Programmable Interface – a standard for information exchange over the internet). 380 licenses for TPP’s have been issued in the EU (still including the UK) until now. (see below image of the Open banking Monitor by Innopay). The use of the services of these TPP’s are still limited, partly attributed to too complex strong customer authentication (SCA) rules, making data access and related services cumbersome.

Besides the focus of roll out of new regulations, like GPRD, PSD2, AMLD5, policy makers have not been standing still over the past year. But most of these policies have been in the making for years, and now they also look ahead to the future. They begin to realise that the current organisation of supervision, might not be sufficient to cope with increasingly integrated markets. The borders between digital financial services and other digital services fade away, but regulators have difficulty coping with the cross-over. Worries cover in particular Chinese or American Big Tech firms, that have appeared to be much more powerful than the largest banks, bulk with cash and can buy their way into the financial services, often without taking on the burden of financial regulation to its fullest. The regulators and policy makers feel powerless to so much weight, and the urgency is felt to rethink the system, to cope with these developments. The reliance on foreign big firms already feels inescapable, if you look at European digital services consumption. That is unimaginable without Apple, Samsung, Google or Facebook. And the power of the Chinese tech giants, only seems to be in its infancy.

Also, the stock markets, that have made a strong recovery after the first lockdowns kicked in, have been largely led by the big technology firms. Neobrokers, new players that offer low entry barriers, low cost investment and trading opportunities, have taken over the popular position robo-advisors occupied earlier. Especially millennials like to be more in control of their own investments –and take a chance from time to time – driving new money into stock markets, focussed on tech and sustainable funds. Especially during lock down, in the midst of an expected V shape recovery, Neobrokers could hardly handle the numbers of new customers.

There are some new rising stars that might someday take over the leading roles as digital champions. Especially the Neobanks are the most discussed new idols, raising loads of investments and showing fast growth of new account holders. The pandemic has set them back slightly at first, but with strong backing of their Investors, most have taken up the path of growth again. The main issue remains profitability, as banking is only feasible at a large share of the wallet of your customers, which the Neobanks find much harder than acquiring single account clients. But the resilience of investors in this space, might lead to new champions after all. Looking at the developments in Asia, where messaging and finance go hand in hand, the launch of a whatsapp-only bank this year, might show the way for more.

In general, the year has been very positive from the angle of purpose for the financial industry. After years of talking about ethics and the societal role of financial services, we seem to have gone past a tipping point. Now, not only fintech startups try to make the world a little better, but also incumbent asset managers, banks, pension funds and many others really make social and sustainable goals as part of their business. This pushes forward even more initiatives and support for financial inclusion, financial literacy, sustainable finance and financial well-being.

Looking ahead, there are still many uncertainties. Covid-19 has not yet left us and a vaccine or medicine is not yet in sight. Government support for companies in distress because of the corona outbreak or related restrictive measures will end gradually, but quite soon. Only then will become clear how large the damage to the economy is. It is likely though, that the economy will take a big hit from increased unemployment, if not from further measures to prevent further outbreak this winter.

For the industry, also Brexit plays an important role, although most people are already fed up with the politics around it. But the UK is likely to remain an important financial center, even though financial services companies need to cater for differing regulatory regimes in the EU and the UK. The UK will miss the EU and the EU will miss the UK, especially when it comes to solving the larger challenges of the industry: how to create a level playing for digital services, while guarding the competitive position of Europe, privacy of its citizens and resilience of the financial services ecosystem.

Let’s stick together!