Earlier this year, we conducted our biggest survey yet to learn more about how financial executives in Europe perceive the open banking opportunities. Our newly released report zooms into the findings related to the most anticipated use cases. These are the five that came out on top.

In the previous report based on our 2020 survey, we found that financial institutions were investing big in their open banking efforts. But it hasn’t been clear where the money was going – until now.

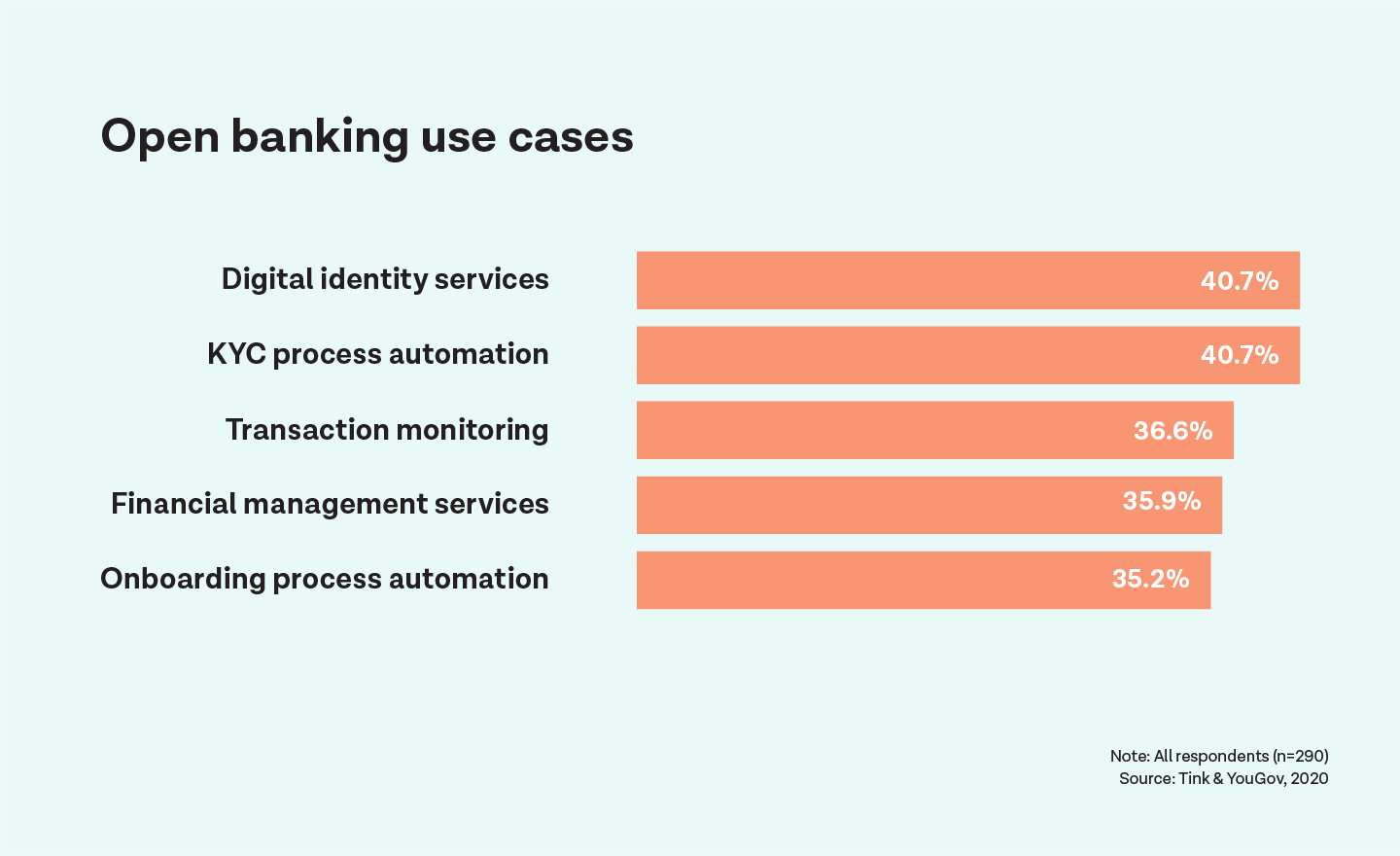

Out of the 14 use cases included in the study, the top three that respondents picked out were related to compliance processes – with 71.4% of the surveyed executives prioritising at least one of the frontrunners: digital identity services, KYC automation and transaction monitoring.

Following closely behind are two use cases related to improvements of the customer experience: financial management services and onboarding automation.

#1(A) – Digital identity services

A hot topic in the world of open banking, it’s no surprise to see digital identity services come out on top. With strong customer authentication being a PSD2 requirement, financial institutions have needed to invest in strengthening their authentication methods.

When looking at the responses per industry segment, digital identity services is priority #1 for traditional retail banks, wealth management banks, credit institutions, and card schemes or issuers.

#1(B) – KYC process automation

Tied for first place, KYC (Know Your Customer) process automation can streamline the necessary customer due diligence procedures by using open banking to fetch and verify customer information.

This use case shoots up as a big priority for smaller financial institutions (with 100-499

employees), which typically have limited resources for compliance operations.

#3 – Transaction monitoring

Transaction monitoring is a requirement that lets payment service providers (PSPs) detect unauthorized or fraudulent transactions by looking for anomalies in the data. Open banking can help improve customer profiles, making it easier to identify abnormal activity when it occurs.

While it’s not the top pick in any of the represented segments, it is the second-largest focus for traditional retail banks, mortgage providers and investment banks.

#4 – Financial management services

Using open banking to aggregate financial information from different accounts and banks can make money management a lot simpler for consumers and businesses alike.

Financial management services ranked high in Italy, Norway, the UK, and Spain – countries that are characterized by significant competition for the digital customer experience.

#5 – Onboarding process automation

The onboarding process for financial institutions can be a big barrier when acquiring new customers. Open banking has the potential to simplify this process by fetching hard-to-access financial information, sparing customers the work.

This is the most important opportunity being pursued by challenger banks which is no big surprise. These newcomers are gaining traction by raising the bar on the customer experience – and making the onboarding as simple as possible so new customers can get started in minutes.

More use cases – and more insights

Want the full scoop on the opportunities that bankers across Europe are looking to take advantage of? The full report is available for download. Find out more about the other use cases included in our research, how all they ranked, and what types of companies are most looking to benefit from them.